Introduction

Misfits Market is a strategic tool for optimizing a portion of your grocery budget, not a total replacement. Its value is unlocked only through a “produce-first, hybrid strategy” and depends on a clear diagnostic of your household’s consumption, location, and shopping habits.

You’re looking for a straight answer on Misfits Market. The problem? You’re stuck in a loop of closely identical analyses listing the same generic pros and cons, leaving you wondering, “But will this actually work for my life?” The agitation is real—the fear of wasted money, spoiled food, and another unused subscription. Let’s cut through that noise. The result is to stop asking “Is it worth it?” and start asking “Am I the correct fit?” This article provides the diagnostic framework—the “Household Fit Profile”—and a realistic integration strategy to give you a clear, personalized verdict.

Key Takeaways:

- Misfits Market has evolved from an “ugly produce” box into a full online grocery marketplace, changing how it should be compared.

- Savings are not universal; they depend on your Household Fit Profile (household size, location, and how you shop).

- The most effective way to use the service is as part of a Hybrid Strategy, using it for your grocery “core” and supplementing with store trips.

- The key difference between Misfits and Imperfect Foods in 2024 is one of strategic posture: aggressive pricing & breadth vs. a lean into organic sourcing.

- Success requires managing logistical realities like delivery timing and inspecting produce upon arrival.

More Than Ugly Produce: Misfits Market’s Full Grocery Pivot

Forget the old narrative. Misfits Market is no longer just a box of quirky carrots and heart-shaped potatoes. Its critical, under-reported pivot is to a full-scale online grocery marketplace. Yes, you can still get surplus and imperfect produce—that’s the engine of its initial savings—but you can now also add pantry staples, dairy, proteins, and snacks in the same order.

This shift fundamentally changes how you must evaluate it. You’re no longer comparing a supplemental box to your grocery haul; you’re comparing one grocery channel to another. The core value proposition is now two-fold:

- Surplus Produce: Sourcing cosmetically imperfect or oversupplied items at lower cost.

- Direct-to-Consumer (DTC) Pantry: Selling shelf-stable goods directly to you, bypassing retail markups.

What this means for you: Your potential savings now span a much wider portion of your cart. However, it also means you need a strategy. Throwing a random assortment of items into your Misfits cart is a recipe for mismatch. The strategic approach is to see it as a source for your predictable, non-perishable, or quickly-used grocery foundation.

The “Household Fit Profile”: Will You Actually Save?

The blanket claim of “save up to 30%” is meaningless without context. Your savings are determined by a three-part diagnostic. Run through this profile honestly.

- Consumption Velocity (The Spoilage Calculus)

This is the most critical factor. Misfits sells produce in volumes that make sense for its supply chain, not necessarily for a single person.

- High-Fit Scenario: A household of 2+ people or an avid cook who prepares most meals at home. A 3-pound bag of onions or 5 pounds of potatoes is a week’s ingredient, not a spoilage threat.

- Low-Fit Scenario: A single person or a couple who eats out frequently. The same volume can lead to waste, which vaporizes any upfront savings. Your freezer and meal-planning discipline become essential

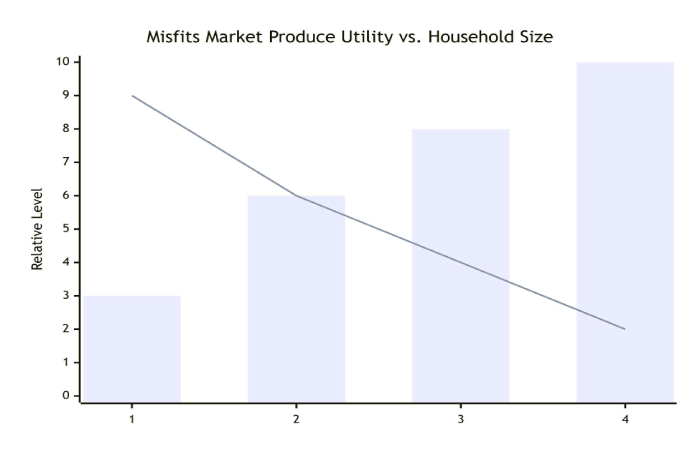

The graph below illustrates the spoilage risk curve relative to household size. It shows how the utility of a standard Misfits produce volume increases dramatically with the number of people sharing it, while the risk of waste diminishes.

How to read this chart: The blue bars represent the utility and cost-effectiveness of a standard Misfits produce volume. The red line represents the relative risk of spoilage. For a 4-person household, utility is high and spoilage risk is low. The opposite is true for a single-person household.

2. The Logistical Sweet Spot (Delivery as a Variable)

Freshness is a function of logistics. Misfits, like all DTC grocers, relies on parcel carriers (like FedEx).

- Urban/Suburban Dwellers: You are in the sweet spot. Dense delivery networks mean reliable, faster transit, leading to better produce condition upon arrival.

3. Your Price Benchmark Mindset

How do you shop currently? Your answer dictates your perception of value. The first table contrasts shopper mindsets, while the second shows how Misfits fits into the broader pricing landscape for a common grocery basket.

| Shopper Profile | Primary Goal | How They Win with Misfits | Potential Pitfall |

| The Set-and-Forget Shopper | Time efficiency, consistent pricing, less decision fatigue. | Locks in mid-range prices on a full cart; avoids premium online grocery markups. | May overpay vs. loss-leader sales on specific items. |

| The Loss-Leader Hunter | Maximizing savings on specific high-value items. | Uses Misfits for a predictable “core” spend, freeing up time/energy to hunt for stellar deals elsewhere. | Using Misfits for everything will feel less optimal than their usual method. |

Comparative Pricing Tiers for a Standard Grocery Basket (Illustrative)

Note: Based on market analysis of a basket including items like bananas, onions, carrots, oats, canned tomatoes, and pasta.

| Shopping Channel | Typical Price Positioning | Key Driver | Best For… |

| Conventional Grocery (In-Store) | Wide Range (Loss-leader to Premium) | Weekly promotions, brand premiums, convenience of selection. | Shoppers who cherry-pick sales and don’t mind multiple stops. |

| Traditional Online Grocery (e.g., Instacart) | Highest (Retail price + fees + markups) | Convenience premium, service fees, and partner markups. | Absolute convenience seekers for whom cost is secondary. |

| Misfits Market | Consistently Mid-Range | Surplus sourcing and DTC model cutting out retail markups. | Shoppers seeking reliable, all-in-one pricing without hunting sales. |

| Warehouse Clubs (e.g., Costco) | Lowest per unit, but high upfront volume & cost | Bulk purchasing power and membership model. | Large families with ample storage who can commit to volume. |

The Strategic Insight: Misfits Market doesn’t always have the absolute lowest price on every item. Instead, it offers a compressed range—eliminating the highest prices you’d pay for convenience while rarely hitting the rock-bottom prices of a perfect sale. This makes your total grocery bill more predictable and often lower than a typical convenience-focused shop.

The Winning Hybrid Strategy: Integrating Misfits Market

Trying to make Misfits Market your only grocer is a strategic error. The winning play is the Hybrid Strategy.

Use Misfits for your “Core”:

- Staple Vegetables: Onions, potatoes, carrots, celery, bell peppers, leafy greens (if you’ll use them fast).

- Cooking Aromatics: Garlic, ginger, herbs.

- Pantry Basics: Oats, rice, dried beans, canned tomatoes, pasta, cooking oils, spices.

- Everyday Proteins: Eggs, often certain cuts of chicken or plant-based proteins (price-check vs. sales).

Use Your Local Store for the “Periphery”:

- This week’s loss-leader sale items.

- Last-minute needs (a gallon of milk, a lemon).

- Specific brand-name items you’re loyal to.

- Items where you need to select exact ripeness or cut (like a single avocado for tonight).

Example Weekly Integration:

- Misfits Order: Sweet potatoes, onions, spinach, mushrooms, bananas, oats, canned chickpeas, pasta, marinara sauce.

- Store Trip: Sale-priced chicken breasts, milk, cheese, fresh bread, and the chocolate bar you impulsively toss in the checkout lane.

This system leverages Misfits for cost-effective foundation building and the store for flexibility and peak bargains.

Optimization Table: The Hybrid Strategy Planner

| Grocery Category | Buy from Misfits When… | Buy from Store When… |

| Produce | Buying hardy staples (roots, alliums) or volume for planned meals. | You need 1-2 specific ripe items today or want to select exact appearance. |

| Pantry | Stocking up on non-perishable staples (rice, beans, flour). | You need a one-off, name-brand ingredient for a special recipe. |

| Proteins | The price per pound beats your store’s regular price. | There’s a spectacular sale or you want to inspect the cut/freshness personally. |

| Dairy | You use a lot of a specific item (e.g., a dozen eggs weekly). | You need a small quantity or a perishable item with a short shelf life. |

The 2024 Competitive Landscape: Strategic Postures, Not Features

Comparing Misfits to Imperfect Foods via a simple feature table misses the point. In 2024, they have diverged in strategic posture, as shown in the comparative analysis below.

| Misfits Market | Imperfect Foods | Thrive Market | |

| Strategic Posture | Aggressive on Price & Breadth | Leans into Organic & Sourcing Story | Membership Club for Specialty |

| Core Model | À la carte marketplace, no fee. | À la carte marketplace, no fee. | Paid annual membership ($60/yr) required. |

| Produce Focus | Strong mix of conventional and organic; breadth is key. | Noticeably emphasizes organic; curation feels intentional. | Limited; primarily pantry-focused. |

| Best For… | The shopper who wants maximum affordability and a one-stop shop for a wide grocery list. | The shopper for whom organic sourcing is a primary filter and who connects with farm narratives. | Households that consistently buy natural, organic, keto, or gluten-free branded goods. |

Key Takeaway: Misfits and Imperfect Foods are now direct competitors, but their subtle posturing means one will likely align better with your priorities. Thrive serves a different, specialty-driven need entirely.

The Logistics Reality: Setting Expectations

Trust is built on honesty, not hype. Here’s what to expect logistically.

- Freshness Variability: Produce is often different, not worse. A two-legged carrot is fine. However, delivery is a variable. Always inspect your box within hours of delivery and immediately refrigerate what needs it. Misfits’ customer service, as noted in widespread user reports on platforms like Trustpilot, is generally responsive to refunds for spoiled items if contacted promptly.

- The Packaging Waste Irony: This is the systemic flaw of all DTC grocery. While Misfits uses recycled and compostable materials (a step better than plastic foam), it’s still more packaging than a reusable bag. It’s a trade-off: reduced food waste at the farm vs. increased packaging waste at your door.

- Customer Service Model: Expect a digital-first, efficiency-driven model. Reach out via chat or email for issues like refunds. Don’t expect a dedicated phone line. This is standard for the operational scale they’re running.

Final Verdict: A “Yes, If…” / “No, If…” Decision

Apply the Household Fit Profile for your final answer.

Yes, consider Misfits Market IF you check these boxes:

- Your household has 2+ people or high produce consumption.

- You live in an area with reliable parcel delivery (urban/suburban).

- You want to lock in consistent prices on your grocery “core” and are willing to build a hybrid shopping habit.

- You cook at home regularly and can incorporate slightly imperfect ingredients.

No, Misfits Market is likely not your best tool IF:

- You are a single person with low weekly produce use.

- Your primary shopping joy is hunting the deepest loss-leader sales and you rarely pay full price for anything.

- You lack the freezer space or meal-planning rhythm to use bulk produce efficiently.

- You require 100% perfect-looking, store-selected individual pieces of fruit.

Final Recommendation: If you fit the profile, start strategically. Place a small first order focused on hardy produce and pantry staples you know you’ll use. Test the logistics, the quality in your area, and see how the Hybrid Strategy feels. You’re not just trying a box—you’re piloting a new system for one part of your grocery ecosystem.

About This Analysis: This review was developed by applying a consumer strategy framework to the Misfits Market model. It synthesizes operational analysis of the service, review of public materials like the company’s annual Impact Report, and patterns observed in aggregated user feedback to create actionable decision-making tools. Our goal is to move beyond surface-level pros and cons to provide readers with a diagnostic framework for their own household. For more on our review methodology, see our editorial standards.