The medical startups to look out for are not those raising the most capital, but those building durable healthcare infrastructure with regulatory defensibility and scalable impact.

Healthcare innovation is louder than ever. Every week, a startup claims to reinvent medicine with AI. Funding announcements dominate headlines. Yet most of these companies will never fundamentally reshape healthcare systems.

If you are searching for medical startups to look out for, the direct answer is this: focus on companies building infrastructure—AI drug discovery platforms, surgical robotics systems, regulated diagnostics hardware, and care delivery networks embedded into clinical workflows.

The Real Shift in Healthcare Innovation

Healthcare is shifting from reactive treatment toward predictive infrastructure.

Three structural bottlenecks drive innovation:

- Drug development timelines that stretch beyond a decade.

- Diagnostic access limitations.

- Overloaded hospital systems.

Organizations like the FDA and the European Medicines Agency increasingly shape how startups scale. Regulatory alignment is not optional—it is foundational.

Why Most “Medical Startup” Lists Mislead

Most lists rank startups by funding raised.

That is incomplete.

Funding reflects investor sentiment. It does not guarantee:

- Clinical validation.

- Reimbursement support.

- Long-term defensibility.

A consumer health app can scale rapidly. A robotics platform scales slowly—but creates high switching costs once integrated.

Healthcare rewards integration, not virality.

AI Drug Discovery

| Details | Category |

| AI-driven target identification & molecule discovery | Primary Focus |

| Recursion OS, automated phenomics platform | Key Products |

| Enterprise pharma partnerships (multi-million USD research deals) | Pricing Model |

| Large pharma & biotech companies | Client Type |

| Milestone payments + royalties | Revenue Model |

| Highly innovative; capital intensive; long ROI cycle | Reviews (Industry View) |

| Computational biologists, data scientists, medicinal chemists, regulatory experts | Specialists Involved |

| 30–50% faster early-stage discovery vs traditional | Average Development Timeline |

| USA (HQ), UK partnerships, global pharma collaborations | Countries Active |

| High R&D risk, high long-term upside | Risk Level |

Digital Diagnostics

| Category | Details |

| Primary Focus | Autonomous AI-based disease detection |

| Flagship Product | IDx-DR (Diabetic Retinopathy detection) |

| Regulatory Status | FDA-cleared autonomous diagnostic AI |

| Pricing Model | Per-scan fee ($20–$40) or institutional subscription |

| Target Users | Primary care clinics, hospitals |

| Specialists Required | Ophthalmologists (oversight), imaging technicians, AI engineers |

| Key Benefit | No specialist required at point-of-care screening |

| Countries | USA (strong adoption), Europe (moderate), India (growing pilots) |

| Reviews | Improves early detection; reduces specialist bottlenecks |

| Cost Barrier | Moderate initial device + software integration cost |

At-Home Testing Platforms

| Category | Details |

| Primary Focus | AI-supported at-home lab testing |

| Popular Products | STD panels, hormone tests, heart health tests |

| Pricing Range | $89–$249 per test |

| Result Time | 2–5 days average |

| Specialist Access | Nurse consult included; physician follow-up optional |

| Revenue Model | Direct-to-consumer (B2C) |

| Countries Served | USA, UK, Ireland, Canada (limited EU access) |

| User Reviews | 4–4.5★ average; praised for convenience |

| Key Advantage | Privacy + no clinic visit required |

| Limitations | Premium pricing vs local lab testing |

Virtual Care Infrastructure

| Category | Details |

| Primary Focus | Telehealth backend infrastructure |

| Core Services | Clinician network, APIs, compliance support |

| Pricing Model | Per-visit fee ($30–$80) + enterprise subscription |

| Target Clients | Health startups, retailers, digital brands |

| Specialists | Licensed physicians, nurse practitioners, compliance officers |

| AI Role | Patient triage & workflow automation |

| Geographic Focus | Primarily USA (state licensing dependent) |

| Business Model | B2B white-label telehealth enablement |

| Reviews | Reliable infrastructure; strong compliance support |

| Limitation | Limited outside US regulatory framework |

Surgical Robotics

| Category | Details |

| Primary Focus | Robot-assisted minimally invasive surgery |

| Flagship Product | da Vinci Xi system |

| System Cost | $1.5M–$2M per robot |

| Per Surgery Cost | $3,000–$6,000 (disposables + usage) |

| Procedures | Urology, gynecology, general surgery |

| Specialists | Robotic surgeons, surgical nurses, biomedical engineers |

| Countries | USA (high adoption), Japan, Germany, India (private hospitals) |

| Reviews | Extremely precise; high learning curve; expensive |

| Revenue Model | Equipment sales + recurring consumables |

| Barrier | High capital investment |

Preventive Care Platforms

| Category | Details |

| Primary Focus | AI-driven risk prediction & chronic care management |

| Platform Types | Wearable apps, remote monitoring, lifestyle coaching AI |

| Pricing | $10–$40/month (consumer); enterprise contracts for employers |

| Target Users | Individuals, employers, insurers |

| Specialists | Data analysts, health coaches, physicians, behavioral scientists |

| AI Functions | Risk scoring, anomaly detection, engagement nudges |

| Countries | USA (high), UK (moderate), India (rapid startup growth), Australia |

| Reviews | Strong engagement; mixed long-term compliance |

| Key Advantage | Early disease detection & reduced hospitalization risk |

| Limitation | Requires consistent user participation |

Investor-Focused Profitability Comparison – Healthcare AI & MedTech Sectors

| Segment | Typical Revenue Model | Profitability Drivers | Key Cost Factors | Time to Breakeven | Typical Margin Profile |

| AI Drug Discovery | B2B research/licensing | Proprietary data + pharma partnerships | R&D, clinical validation | 7–10+ years | Low short-term; high long-term |

| Digital Diagnostics | Per-scan fee + enterprise software | Volume adoption in clinics, faster workflows | Device deployment & support | 3–5 years | Moderate if regulation aligned |

| At-Home Testing Platforms | Direct-to-consumer | High per-test margins + repeat customers | Lab processing, logistics | 2–4 years | High (consumer pricing) |

| Telehealth Infrastructure | Subscription + per-visit fees | Scale via partner networks | Compliance/licensing, IT ops | 3–6 years | Moderate-high with scale |

| Surgical Robotics | Capital equipment + consumables | High switching costs + service contracts | Manufacturing, training, support | 5–8 years | High once adopted |

| Preventive Care Platforms | Subscription + enterprise | Engagement & retention | Customer acquisition & tech maintenance | 3–5 years | Variable (dependent on adoption) |

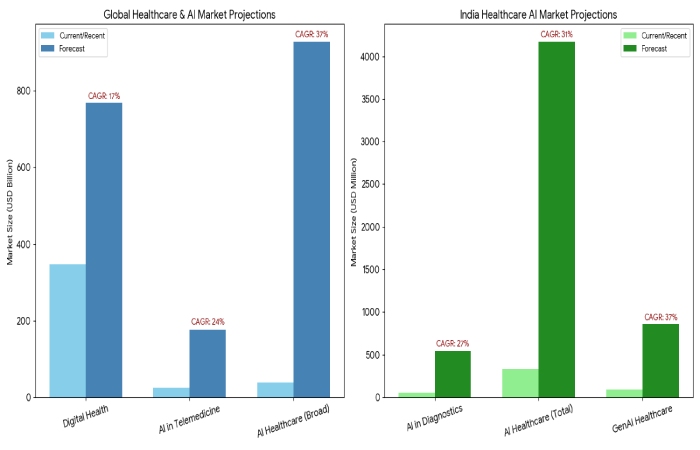

Global Market Size & CAGR – AI Healthcare & Digital Health

| Market Category | Estimated Size (Most Recent) | Forecast (2030+) | CAGR | Notes |

| Global Digital Health | ~$347B (2025 est) | ~$768B (2030) | ~17% | Driven by telemedicine, wearables, AI tools (GlobeNewswire) |

| AI in Telemedicine | ~$26B (2025) | ~$177B (2034) | ~24% | Expansion of clinical triage, risk assessment (Precedence Research) |

| Global AI Healthcare (Broad) | ~$38B (2025 est) | ~$928B (2035) | ~37% | Long-term transformative growth (Towards Healthcare) |

| AI in Medical Diagnostics (India) | ~$55M (2024) | ~$547M (2033) | ~27% | Driven by radiology & pathology AI (IMARC Group) |

| AI Healthcare India (Total) | ~$333M (2024) | ~$4.17B (2033) | ~31% | Broad AI adoption across care + management (IMARC Group) |

| AI Generative Healthcare (India) | ~$93M (2023) | ~$857M (2030) | ~37% | Fastest growth among AI segments (Grand View Research) |

India-Focused AI Healthcare Opportunity Table

| Category | Opportunity Driver | Estimated India Market (Current / Forecast) | CAGR | Local Nuance |

| AI in Healthcare (Broad) | Government + private adoption | ~$333M (2024) → ~$4.17B (2033) | ~31% | Rapid integration across care levels (IMARC Group) |

| AI in Medical Diagnostics | Radiology & pathology efficiency | ~$55M (2024) → ~$547M (2033) | ~27% | Hospitals adding imaging AI (IMARC Group) |

| Generative AI Healthcare | NLP/GenAI health workflows | ~$93M (2023) → ~$857M (2030) | ~37% | Large growth in solutions segment (Grand View Research) |

| Digital Health (Overall) | Telemedicine + AI tools | $14.5B (2024) → $107B (2033) (digital health overall) | ~25% | Inclusion of wider digital health ecosystem (Grand View Research) |

| AI in Telemedicine | Remote care penetration | ~$26B (2025 global, India rapidly adopting) | ~24% | Tech enabling remote care & triage (Precedence Research) |

| Healthcare AI Workforce & Support | AI policy + skill ramp | Digital missions & AI missions expanding labs/training | – | Government incentives for AI labs & skills (The Times of India) |

Risks & Red Flags

| Red Flag | Why It Matters |

| No regulatory clarity | Delayed market entry |

| No reimbursement path | Revenue instability |

| Heavy marketing, weak validation | Clinical risk |

| Unsustainable burn | Dilution risk |

2026–2030 Outlook

Expect:

- AI-designed drugs entering advanced trials.

- Robotics adoption beyond elite hospitals.

- Continued regulatory scrutiny around AI.

- Expansion of preventive subscription models.

Healthcare innovation is entering a disciplined phase. Durable systems will win.

Conclusion: Medical Startups to Look Out For

Medical startups today are not simply building apps or devices — they are redesigning how healthcare is discovered, delivered, and financed. The most promising startups operate at the intersection of AI, automation, clinical validation, and scalable infrastructure.

Across the segments discussed — AI drug discovery, digital diagnostics, at-home testing, telehealth infrastructure, surgical robotics, and preventive care platforms.